Dear Friend,

Last Thursday we wrapped up Week 4 of Committee Meetings ahead of the 2022 legislative session. Bills are already beginning to move, so all of us need to be aware – and ready to respond. Scroll down to see what happened last week and click here to read about Week 3.

Remember: Our Legislative Updates are thorough, but will never be all encompassing. Be sure to keep up to date with us in real time via Facebook, Instagram, Twitter, and YouTube. You can also watch Committee Meetings live at The Florida Channel.

Onward,

Rep. Anna V. Eskamani

Marching Toward Authoritarianism: DeSantis Calls for Even More Limits on Voting

Continuing his drift toward authoritarianism, Gov. Ron DeSantis announced last week that he will push for another round of anti-Democratic restrictions meant to make it harder for Floridians to vote – particularly folks who can’t afford to take time off during a workday, who don’t have access to a car or face other barriers to casting in-person ballots on Election Day.

Earlier this year, DeSantis signed a draconian elections bill (known as Senate Bill 90) that, among other things, limited the availability of ballot drop boxes. But now he wants to get rid of drop boxes entirely.

DeSantis also wants to take further steps to prevent people from helping family members, friends and neighbors vote, and force local election officials to purge more people from the voter rolls entirely.

The governor’s hypocrisy here is stunning. In 2019, he signed the law that allowed ballot drop boxes in Florida – only to get upset when large numbers of Democratic voters cast ballots by mail during the COVID19 pandemic.

What’s more, DeSantis himself has said repeatedly that Florida’s 2020 elections were the most secure in the country, and local election officials -– Republicans and Democrats alike –- have been with elected leaders to stop fanning election lies and conspiracy theories that undermine public confidence in elections. Yet DeSantis rolls out another Orwellian “election integrity” package, solely because he’s more concerned about winning the Republican nomination for president in 2024 than he is about destabilizing American democracy.

Meanwhile, DeSantis continues to say and do nothing about the only real election fraud that happened in Florida in 2020: The plot by Tallahassee Republicans to use sham “ghost” candidates to confuse and deceive voters in key state Senate elections.

The Florida Elections Commission has recommended that one of those candidates –- who was allegedly bribed to run by a Republican lobbyist and former state senator –- be fined $40,000 and censured by the governor.

But DeSantis claims he hasn’t had time to review the case.

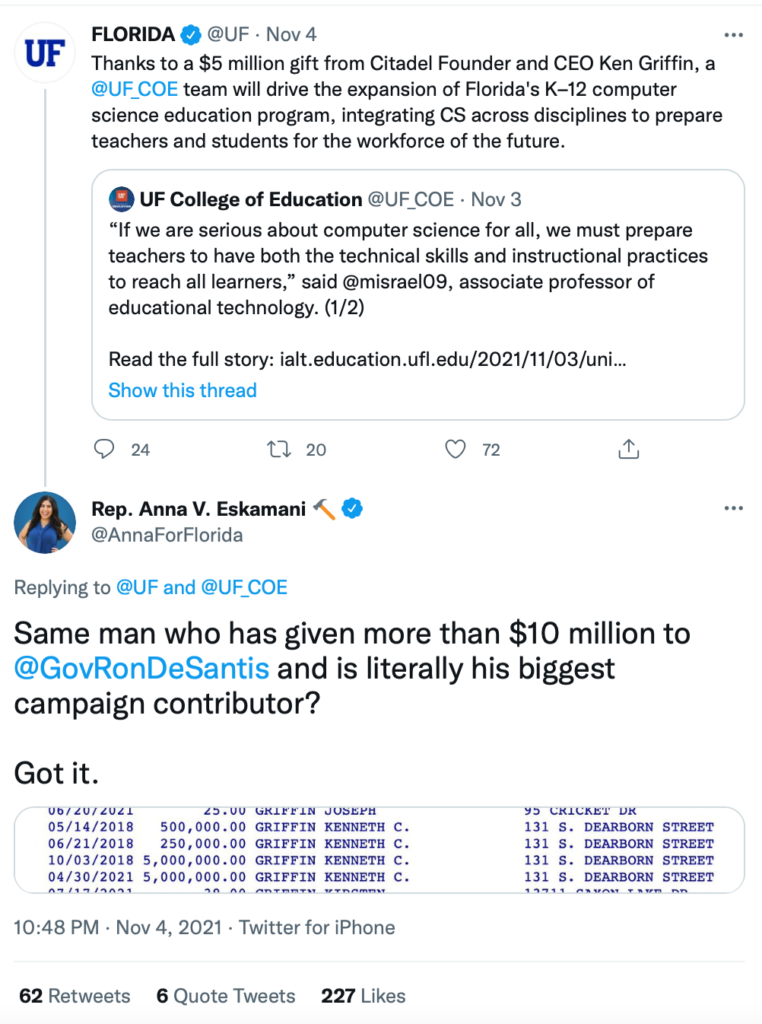

UF as DeSantis Propaganda Arm

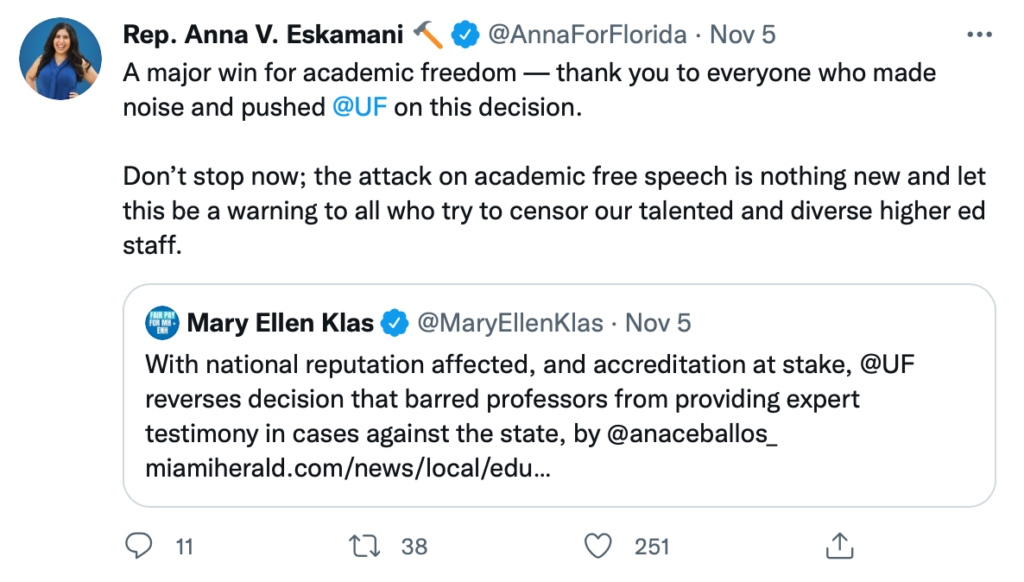

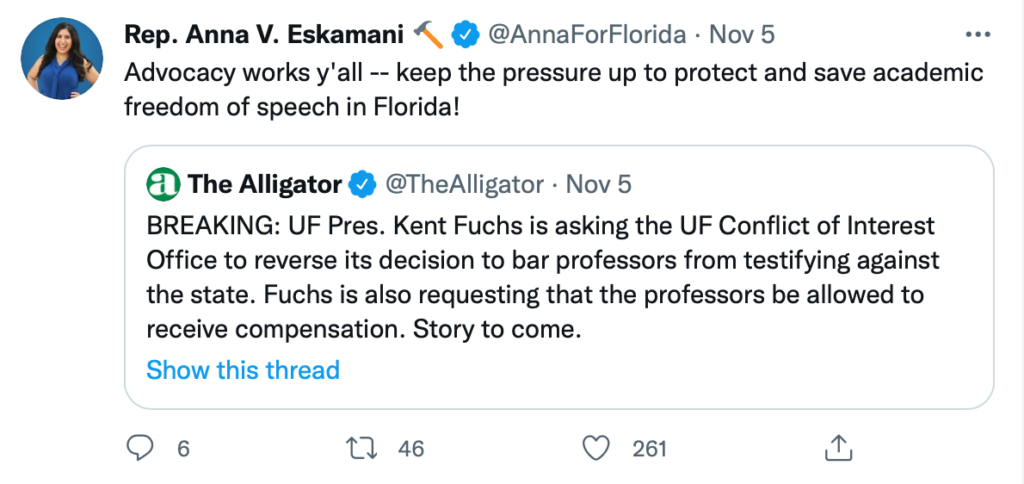

On Friday, the University of Florida announced that it would no longer prohibit three of its professors from testifying as paid expert witnesses in a voting-rights lawsuit challenging the awful elections-restriction law that Gov. Ron DeSantis signed earlier this year.

So UF reversed a chilling decision that undermined the very principle of academic freedom that universities are supposed to embody. That’s good. And it’s a credit to all of us who worked together to publicly pressure UF into doing the right thing.

But it isn’t enough. UF still has not changed the underlying policy that allows university administrators to suppress the voices of professors who wish to testify in cases that might antagonize Gov. Ron DeSantis and leaders in the Florida Legislature.

This wasn’t an isolated example. The Tampa Bay Times and Miami Herald reported this week that UF leaders have restricted at least eight professors from participating in cases against the state in just the last year, including professors who wanted to participate in cases challenging a law disenfranchising former felons and an order banning mask mandates.

And it’s the latest in a series of troubling developments raising questions about the academic independence of our state’s flagship university. For instance, UF administrators recently fast-tracked the hiring of DeSantis’ pick for surgeon general – an anti-vaccine fringe doctor – to a tenured position at its medical school.

That hiring was pushed along by UF’s Board Chair, a homebuilder who raised money to help DeSantis win election as governor who DeSantis then put on the board that governs UF. In fact, a Politico Florida analysis found that the six appointees that DeSantis has named to the UF Board of Trustees and the companies they run have donated nearly $1 million combined to his campaign accounts and to the Republican Party of Florida just since 2018.

For years now, Tallahassee Republicans have been engaged in an intentional campaign to cow Florida universities into stifling academic expression and to turn them into political propaganda tools. DeSantis and legislative leaders have repeatedly threatened funding cuts against schools that displease them, forced out respected academic leaders, and, most recently, forced campuses to engage in sham “intellectual freedom and viewpoint diversity” surveys that are actually designed to silence professors.

But as UF’s reversal shows, we can have the power to push back. We’ve said it before: Advocacy works, y’all.

Ending Corporate Giveaways and Bringing Transparency for Tax Breaks

I like to joke that I’m a tax nerd. But what really means is that I’m passionate about making Florida’s tax system fairer for everyday working folks and rooting out all the hidden giveaways that have been tucked inside the tax code to benefit big corporations and reward wealthy campaign contributors.

Last week, I filed three bills to help push Florida in that direction.

The first bill (HB 359) takes the first step in phasing out corporate giveaways by forming an anti-poaching agreement among state governments that prohibits states from offering company-specific tax incentives or company-specific grants as an inducement for entities to relocate existing facilities. The interstate compact would also create a national board of experts charged with finding more ways to help state and local governments escape from the current “prisoner’s dilemma” of economic development and instead implement a level playing field for all employers, big and small.

Corporate giveaways, which often go to the corporations that make the biggest campaign contributions or employ the most expensive roster of lobbyists, are an expensive, inefficient and ineffective use of taxpayer dollars to create and maintain jobs. Unfortunately, lawmakers across the country and right here in Florida face a prisoners’ dilemma — we feel forced to participate in corporate giveaways because nearly everyone else does. The only way to end this race to the bottom is an interstate agreement that phases us all away from this ineffective and wasteful game while removing the parts of Florida statute that feeds into this problem.

The second bill (HB 6059) would repeal a law that allows corporations like Amazon and others that try to squeeze publicly funded incentive packages from local governments to hide the details of those discussions for up to two years. These so-called “economic development” deals would instead have to be negotiated in broad daylight – where all taxpayers could weigh in and evaluate the proposed agreements for themselves.

Transparency is the cornerstone of good government – especially when we’re talking about giving away Floridians’ hard-earned dollars. The only one who benefits when an incentive package is negotiated in secret is the big business that is trying to play states and cities against each other and win the most lopsided deal it can.

And the third bill (HB 6041) would repeal Florida’s “Urban High-Crime Area Job Tax Credit Program.” This was a tax break created more than 20 years ago that was supposed to draw investment to poverty-stricken urban communities around the state. But it has instead become a permanent taxpayer subsidy for Universal Studios, the Orlando resort that is owned by Comcast Corp. — one of the world’s biggest and most profitable corporations.

Since 1999, Florida taxpayers have paid out $35.2 million through the high-crime incentive program — and $17.4 million of that has been paid to Universal’s theme parks and hotels. Walmart ($2.5 million) and Publix ($1.1 million) have also profited off the program.

Even the law’s original sponsors, who wanted to help neglected communities like Orlando’s Historic Black neighborhood Parramore, say the program has been abused. But the Republican-controlled Florida Legislature has repeatedly refused to reform the program because Universal has lobbied against it. This program should end.

Working Floridians are struggling to afford rent, small businesses are fighting to keep their doors open, inflation is high and public agencies are struggling to meet the needs of our communities. Floridians need help, and we need to deliver it to them. And one of the ways we can do that is by eliminating wasteful corporate tax breaks that do nothing but pad the profits of politically influential corporations and instead use the money to deliver real relief to real people.

Freeing Up Hotel Taxes for Mass Transit and Affordable Housing

Here’s another example of another hidden corporate subsidy baked into our tax laws that our team wants to end.

For years, big theme parks, hotel chains and other tourism industry interests have lobbied hard in Tallahassee to prevent local governments from spending hotel taxes on local needs – via state laws that force counties to use that tax money subsidizing the tourism industry through things like television advertising and convention centers.

Now, there is a provision in the law that lets counties spend hotel taxes building major public infrastructure – like roads, transit systems or water-treatment plants. But there’s catch: They can only use hotel taxes on infrastructure if they already spend at least 40 percent of their hotel taxes on advertising.

That restriction was added at the request of lobbyists representing Walt Disney World, Universal Orlando and other Central Florida tourism businesses. And it’s what prevented Orange County from using hotel taxes in December 2019 when it promised to give up to $125 million to Universal to pay for a new road to Universal’s Epic Universe theme park. (Orange County ended up using property taxes and impact fees instead – money that could have otherwise been spent on local needs.)

We’re going to tear down this unnecessary and unwarranted barrier. Last week, I filed HB 6075, to remove that 40 percent restriction – which does nothing but handcuff Orange and other counties and prevent them from making decisions themselves about the needs of their communities.

Orange County collects more hotel taxes than any other county in the state – and it also facing some of the most severe transportation and affordable housing challenges in the state. And by removing this 40 percent restriction, Orange County would be free to spend hotel taxes on things like expanded Lynx bus service around Disney or a SunRail connection to Orlando International Airport – services that would provide real help to frontline tourism workers.

What’s more, this could have an even bigger indirect impact.

For example, the local tourism industry is currently pressing Orange County to spend upwards of $100 million on a shuttle service linking Universal’s theme parks and other attractions around International Drive and roughly $20 million on a pedestrian overpass at I-Drive and Sand Lake.

The county currently plans to use property taxes to help pay for these projects. But my bill would allow them to use hotel taxes instead – freeing up those property taxes to be spent on more urgent needs, such as our region’s acute lack of affordable housing.

I’m pleased to announce that grassroots groups like Orlando YIMBY are already supporting this idea. Lots of elected officials in Central Florida talk about supporting our tourism industry – but that MUST include supporting our tourism workers, too. This legislation will help us do that.

A Little Light Reading to Prepare for a Big Tax Battle

I know tax policy may seem intimidating and arcane. But it doesn’t have to be. And it affects literally everything – unfair tax laws are one of the biggest drivers of income and wealth inequality and they are ultimately what determines how much or how little we have to invest in life-altering services such as early childhood education, affordable housing, healthcare and combating climate change.

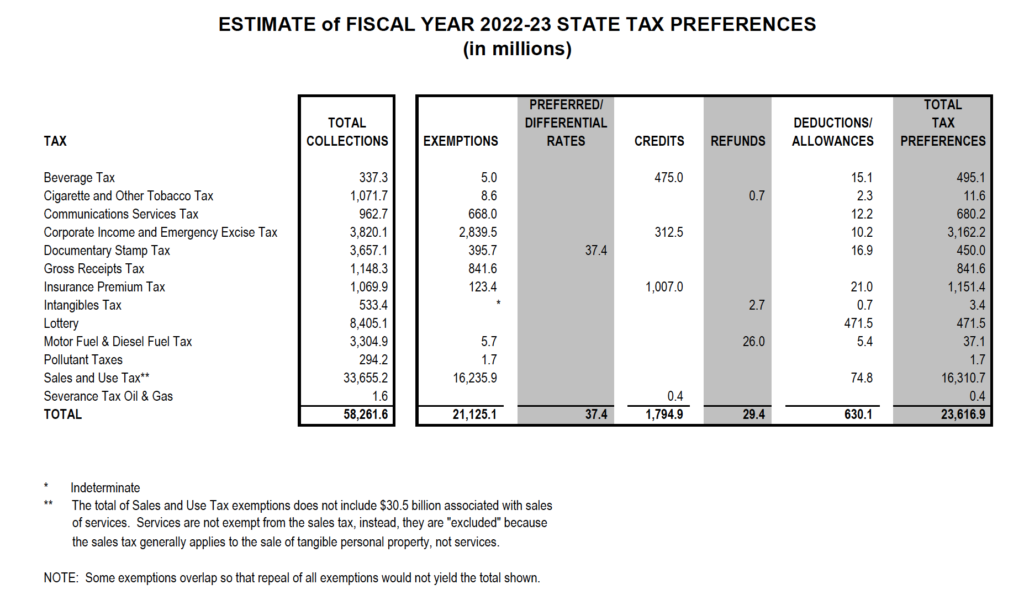

In fact, I’d encourage to spend some time reading through the Florida Tax Handbook, which provides a comprehensive overview of how Florida’s $100 billion government is funded. You’ll find lots of interesting, and often alarming details – like the fact that Florida now almost gives away as much money in corporate tax breaks as it raises in corporate taxes (see page 30).

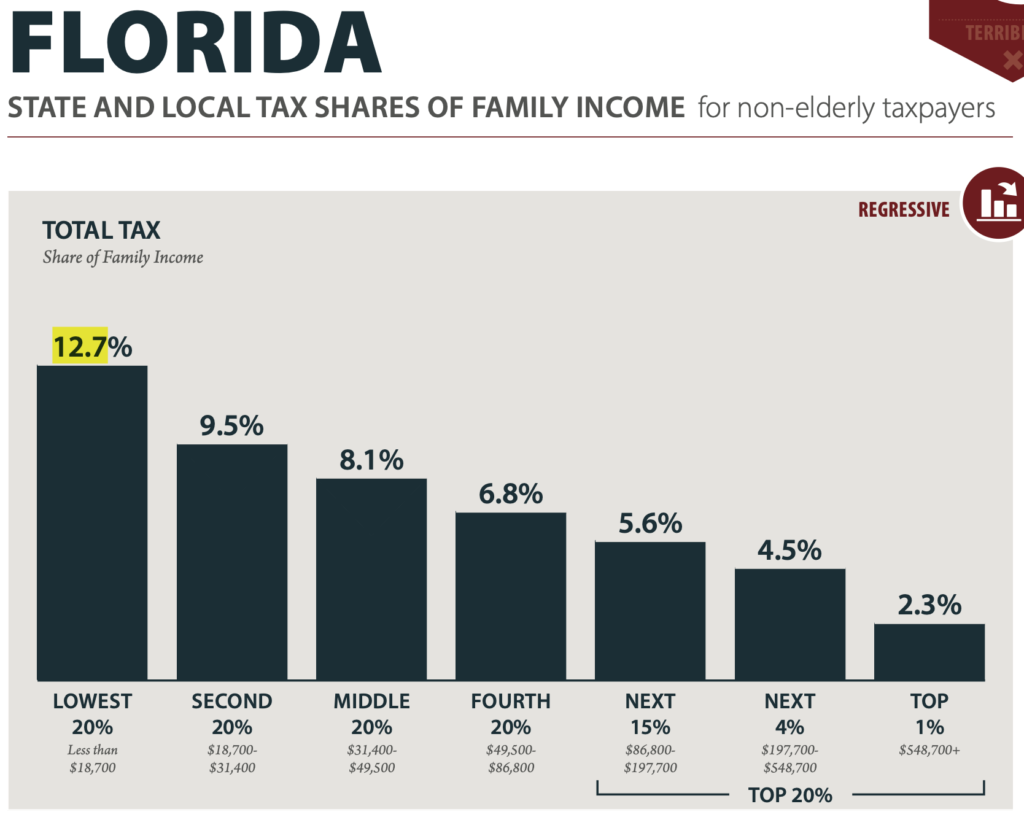

And you should also check out this report by the Institute on Taxation and Economic Policy which analyzes just who ends up paying those state taxes. In Florida, for instance, families in the lowest 20 percent of household income end up paying 12.3 percent state and local tax rate – while the top 1 percent pay just 2.3 percent. Florida has the third most-regressive tax system in the country.

It’s important that we’re smart about this – because corporations and their lobbyists are pushing hard to make things even more lopsided.

Republican leaders in the Florida Legislature recently gave a massive, $3.6 billion tax break the to the state’s biggest corporations — and only the state’s biggest corporations. That included roughly $540 million in corporate tax refunds given away in May 2020 and another $620 million in refunds to be doled out this spring, plus another $2.5 billion in savings from dramatically slashing Florida’s corporate tax rate from 5.5 percent to 3.5 percent through the end of 2021.

And now these some corporations – companies like Disney, Comcast, Walmart and Publix – are lobbying to make those tax breaks permanent, which save themselves billions more in the future and force working Floridians to shoulder an even larger share of the cost of services that everyday folks desperately need.

This will be one of the biggest battles of the 2022 session. We have to be ready.

Restoring Home Rule Powers that the Legislature Has Stripped Away

As passionate as I am about fair tax policy, I’m just as committed to local control – and Florida’s cities, towns, villages and counties can make their own decisions about what’s best for their unique communities.

Unfortunately, Republican leaders in the Florida Legislature have aggressively stripped power in recent years from our local governments through so-called “preemptions” that concentrate decision-making power in Tallahassee, where it’s much easier for fossil-fuel polluters, minimum-wage employers and others to concentrate all their lobbying and campaign contributions – and dictate policy decisions.

We should be power to local communities, not taking it away. So last week, I filed a series of bills all aimed at restoring home-rule powers that have been stripped away from cities and counties by a Legislature beholden to big corporations.

Seven bills in all, each would repeal a different preemption that Tallahassee has passed in recent years. They include bills to:

— Protect coral reefs: HB 6019 would repeal a law that prevents local governments from regulating the sale of over-the-counter drugs and cosmetics. Big pharmaceutical and cosmetics manufacturers like Johnson & Johnson pushed this preemption through the Legislature in 2020 after the city of Key West banned the sale of certain sunscreens because of concerns they were damaging delicate coral reefs.

— Better manage the growth of 5G: HB 6045 would restore local government’s management of the distinct engineering, construction, operation, maintenance, public works, and safety requirements of 5G towers.

— Make municipal broadband more accessible: HB6043 would repeal unnecessary laws that have placed undue burdens onto local governments who want to pursue their own municipal broadband options. This would in turn help increase internet access and close tech divides across the state.

— Hold corporate polluters accountable: HB 6003 would repeal a law that blocks cities and counties from enacting “Rights of Nature” policies. Rights of Nature policies, which allow residents to sue on behalf of polluted lakes, rivers and springs, are powerful environmental-protection tools that help ensure corporate polluters are held accountable — which is why developers, fertilizer manufacturers and others lobbied this preemption through the Legislature in 2020.

— Preserve neighborhood beauty: HB 6025 would repeal a law passed in 2019 that prevents cities and counties from setting rules around the pruning, trimming and removal of trees on residential property.

— Reduce barriers to build affordable housing: HB 6057 would repeal a requirement forcing local governments to provide developers an incentive when building affordable housing; developers building affordable housing are already receiving public money to pursue such projects and in most cases local governments are finding ways to offset costs without interference by the state politicians.

— Help renters stay in their homes: HB 6017 would repeal a law that prevents local governments from enacting rent-control policies that save tenants from being forced out of their homes by increasingly unaffordable rents. This dangerous preemption, which apartment developers and managers lobby hard to keep in place, is undermining our ability to solve affordable housing crises in cities across Florida that are pushing more working families every day into homelessness.

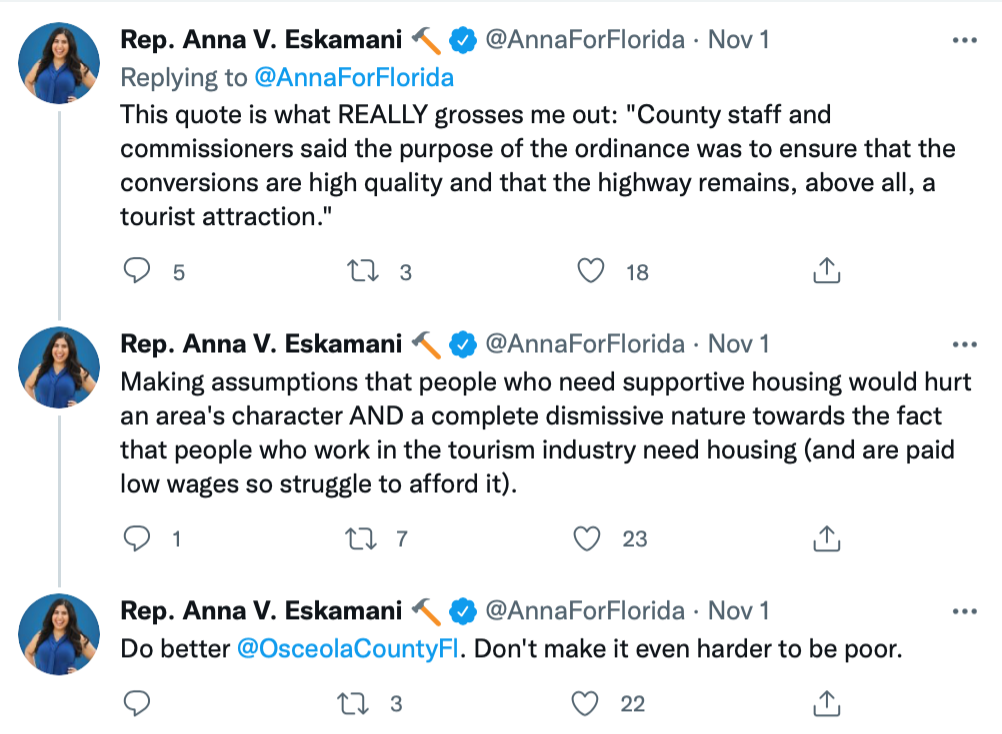

Siding with the Tourism Industry, Osceola County Makes It Harder to Address Homelessness

The lack of affordable housing and families being forced into homeless is a crisis across Florida, especially here in Central Florida, where so many workers are stuck in low-paying part-time jobs without critical benefits such as healthcare.

Some homelessness advocates have been trying to help by acquiring dilapidated, pay-by-the-week motels along U.S. 192 in Osceola County and converting them into affordable housing units.

Unfortunately, Osceola commissioners last week made things much harder last week by passing a tourism industry-backed ordinance that advocates worry will make it practically impossible to renovate existing motels – by requiring a long list of expensive changes, like more open space or even requiring first-floor restaurants.

I was particularly upset to read that the true purpose of this ordinance is “to ensure that the conversions are high quality and that [US 192] remains, above all, a tourist attraction.”

This makes an awful assumption that people who need supportive housing would hurt an area’s character – and it’s completely dismissive of the fact that people who work in the tourism industry need housing yet are paid such low wages that they struggle to afford it.

Committee Meetings

Many committee meetings were canceled last week. In fact, I only had one committee meeting in the House Professions & Public Health Subcommittee and the focus was on staff presentations on bills that become law and on medical cannabis research. You can watch that meeting and all meeting hearings on the Florida Channel here.

Local Governments Matter — So Get Engaged!

The Osceola County vote is a good reminder of something that I worry that too many of us have forgotten: Local government matters and we need to pay more attention to it.

I wrote about this last week in The Community Paper. Far too many folks only pay attention to national politics as opposed to state and local politics – even though local and state politics have a much more direct impact on our everyday quality of life.

Local issues tend to cut across partisan divides, too. Engaging more in local issues can help counter the extreme polarization we’re seeing across all levels of government as more and more folks have come to follow only the presidency on CNN and Fox News instead of their city council in the pages of their local newspaper.

The Week in Pictures